Medicaid is one of the primary ways to pay for long term care. Find out more about Medicaid to learn how it pays for your care. It is important to compare coverage options and shop around. Understanding the role of Medicaid in paying for long term care insurance is essential before purchasing. Be sure to get the right coverage and not only what you think is necessary. Long-term care insurance is an excellent way to protect yourself against major financial loss, but it does not provide complete coverage.

Costs

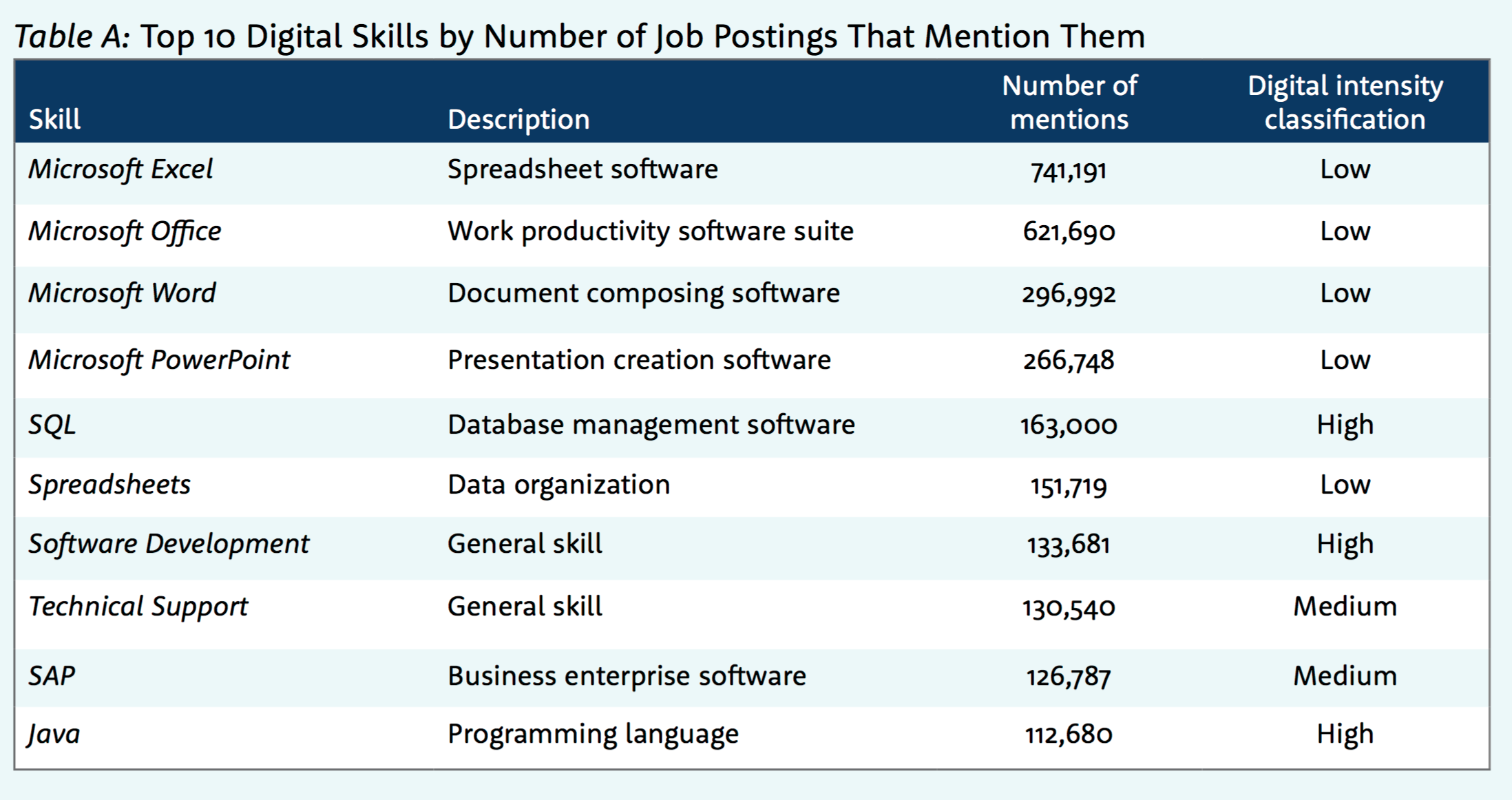

Prices for long-term health insurance differ depending on the age of the person and their gender. The average 55-year-old male will pay $1,092 a year for a policy, while a 65-year-old female will pay around $158 per month. The American Association for Long-Term Care Insurance produces a 2022 Price Index. For example, a couple might pay $2,080 annually for two policies with $168,500 value at 85.

Long-term care insurance prices can vary widely depending upon where you live, how much care you need, and what company you work for. Genworth has a cost estimator that will help you find the median cost for different regions of the country. It is easier to plan ahead if you know the average cost. Medicaid and reverse loans can help you to pay for long-term medical expenses. This may be a viable option for you if you're concerned about costs.

Coverage

The federal government offers a Medicare Advantage program, which covers long-term health care. Regular insurance plans do NOT cover this. These plans offer Medicare benefits, plus additional benefits such hearing aids or vision care and gym memberships. Medicare Advantage plans have been offering long-term services since 2019 and will likely expand their coverage in 2020. You may also be eligible for adult day care, home modifications, and non-emergency travel. You will have to pay the cost of services if you don't qualify for Medicare LTC.

Medicare was originally created to provide healthcare for the elderly and disabled. The statute however did not include custodial, which is help with ADLs, such as bathing or eating. Although the Federal-State Medicaid program was intended to assist people with LTC, it can't prevent financial ruin that is caused by an excessive need for LTC. LTC services can be expensive and often not accessible to the majority of people. It is therefore crucial that you identify LTC coverage.

There are several options

Original Medicare doesn't cover long-term care. However, Medicare Advantage slowly expanding coverage. In addition, there are a number of private options for paying for care, including long-term care insurance, government aid, and hybrid policies, which combine life insurance and long-term care coverage. The amount of coverage you receive depends on your needs and circumstances. Contact your Medicare provider to learn more about your options.

Medicare Advantage plans can provide additional benefits like nursing home and hospice care. But, Medicare Advantage plans may only offer coverage for certain levels of care. Medicaid is a popular option for long-term care insurance coverage, but eligibility requirements differ by state. Medicaid eligibility is usually extended to people earning up 138% of the federal poverty line, but not all qualify for this coverage.

Medicaid's role in paying for long-term care

Medicare is an important source of funding for long term care. However, it's not the only source. Many private insurance plans also cover a portion of long-term care costs. Medicaid's waiver can help you cover the cost of care even if your insurance is not available. However, you must meet certain requirements. This could mean that you have to sell assets in order to pay your financial obligations. Below are some benefits that Medicaid waivers can provide.

First, Medicaid covers the cost of room and breakfast for beneficiaries who receive home-based nursing care. When Medicaid pays for room and board in an institution, it requires that a portion of your income be applied to the cost of care. Medicaid will penalize you if your home is sold for less than the fair market value. Long-term care assistance may be withdrawn. It does not cover care in institutions.

FAQ

How can I get my free health insurance?

If you're eligible, you could apply for free coverage. You might be eligible for Medicaid, Medicare, CHIP, Children's Health Insurance Program (CHIP), Tricare, VA benefits, Federal Employee Health Benefits (FEHB), military health plans, Indian Health Service (IHS) benefits, or some other program.

What will be the impact on the health care industry if there will be no Medicare?

Medicare is an entitlement program that provides financial assistance to low-income individuals and families who cannot afford their premiums. This program is available to more than 40 millions Americans.

Millions of Americans could lose coverage without this program because private insurers wouldn't offer policies to people with preexisting conditions.

What happens if Medicare disappears?

Uninsured Americans will increase. Employers will be forced to terminate their employees' plans. Senior citizens will have to pay higher out of pocket for prescription drugs and medical services.

Statistics

- Foreign investment in hospitals—up to 70% ownership- has been encouraged as an incentive for privatization. (en.wikipedia.org)

- About 14 percent of Americans have chronic kidney disease. (rasmussen.edu)

- Over the first twenty-five years of this transformation, government contributions to healthcare expenditures have dropped from 36% to 15%, with the burden of managing this decrease falling largely on patients. (en.wikipedia.org)

- Consuming over 10 percent of [3] (en.wikipedia.org)

- For the most part, that's true—over 80 percent of patients are over the age of 65. (rasmussen.edu)

External Links

How To

How to Locate Home Care Facilities

People who require assistance at home can use home care facilities. Home care facilities assist those with chronic illnesses, such as Alzheimer's, who can't move or are too elderly to leave their home. These facilities offer services such as personal hygiene, meal preparation and laundry, cleaning, medication reminders, transportation, and so on. These facilities often collaborate closely with social workers, rehabilitation specialists, and medical professionals.

The best way to find a home care service provider is through recommendations from friends, family members, local businesses, or online reviews. After you've identified one or two providers you can start to ask about their qualifications, experience, and references. Flexible hours are important so they can work around your schedule. Also, make sure they offer emergency assistance 24/7.

You might also consider asking your doctor or nurse for referrals. If you don't know how to search, try searching online for "home healthcare" or "nursing home". You could also use websites such as Yelp, Angie's List and HealthGrades or Nursing Home Compare.

You may also call your local Area Agency on Aging (AAA) or Visiting Nurse Service Association (VNA) for additional information. These organizations will have lists of agencies in your area that specialize in providing home care services.

Many home care agencies charge high rates for their services. This makes it important to find the right agency. Some agencies may charge 100% of a patient’s income. Avoid this problem by selecting an agency that has been highly reviewed by the Better Business Bureau. Get references from past clients.

Some states even require homecare agencies that register with the State Department of Social Services. For more information, contact your local government office.

You should consider these things when selecting a home care agency:

-

Avoid any company asking you to pay upfront for services.

-

Choose a well-established, reputable company.

-

For those who are paying out-of-pocket for insurance, make sure you have proof.

-

Verify that the state has granted the agency license.

-

For all costs related to hiring the agency, request a written contract.

-

Check to confirm that the agency offers follow-up visits following discharge.

-

Ask for a list of credentials and certifications.

-

Never sign anything without having read it.

-

Pay attention to the fine print.

-

Insure and bond the agency.

-

Ask how long this agency has been around.

-

Verify that the State Department of Social Welfare licenses the agency.

-

Find out if there have been any complaints about the agency.

-

Call the local government agency that regulates homecare agencies.

-

You should ensure that the person answering the phone has the qualifications to answer your questions about homecare.

-

Ask your lawyer or accountant for tax advice on the use of home-based care.

-

For every home care agency you contact, always get at least three bids

-

The lowest bid is the best but you should not settle for $30 an hour.

-

Remember that you may need to pay more than one visit to a home care agency daily.

-

Always read the contract carefully before signing it.